Arizona GOP announces plan on transportation funding and rental tax repeal: Here's what to know

PHOENIX - On July 31, the Arizona State Legislature passed a bill to allow Maricopa County voters to decide whether to extend a half-cent sales tax for transportation.

The bill, however, made its way to Governor Katie Hobbs' desk with a price to pay, as State Senate Republicans only pushed it through with a repeal of the rental tax.

Here's what you should know about the proposal.

So, what's in the bill?

Maricopa Co. voters to decide on transport funding

Arizona state lawmakers unveiled a new deal on July 31 that would allow voters in the state's largest county to vote on a bill that would extend the decades-long half-cent sales tax that provides funding for various transportation projects in the area. FOX 10's Marissa Sarbak reports.

According to a statement released by State Senate Republicans, the bill, known as SB1102, provides for an extension of a ballot initiative known as Proposition 400.

SB1102, according to the Arizona State Legislature's website, was initially a bill that would have given ADOT $4.5 million to improve an interchange at State Route 303 and US 60.

The bill, however, was subsequently amended in what is known as "strike-everything" amendment. According to a legislative analysis of the newly-amended bill, the Board of Directors in Maricopa County would be directed to call a county-wide election, where voters will be asked on whether or not to continue with half-cent tax that was in Proposition 400.

According to the statement, the proposal was announced after "several weeks of renewed good-faith negotiations between the Senate, House and Governor's Office."

What's Proposition 400?

Two freeways intersect in the Phoenix area.

According to ADOT's website, Proposition 400 was passed by voters in November 2004 as an extension to a previous half-cent sales tax, with an expiry date of December 31, 2025.

In its 2005 annual report on the implementation of Proposition 400, officials with the Maricopa Association of Governments stated that Proposition 400 extended a half-cent sale tax for transportation that was approved by Maricopa County voters in 1985, in what was then called Proposition 300.

Proposition 300, according to the annual report, expired on Dec. 31, 2005.

"There was a tremendous amount of public pressure for the legislature to pass a Prop 400 extension initiative, which would give Maricopa County voters the right to vote on an extension of a half-cent sales tax," said Political Analyst Chuck Coughlin.

Are there any changes for the Proposition 400 extension?

Valley Metro light rail

There are a number of changes listed in SB1102.

Funding Distribution

According to ADOT officials, there is a state law on how proceeds from Proposition 400 can be spent.

Under current law:

- 56.2% of the proceeds is distributed to freeways and state highways

- 10.5% of the proceeds is distributed to arterial street improvements

- 33.3% is distributed to the public transportation fund

According to a legislative analysis published by the Arizona State Legislature, SB1102 would change the funding distribution formula to the following:

- 40.5% of the proceeds is distributed to the Regional Area Road Fund (RARF) for "freeways and other routes in the state highway system, including capital expense and maintenance"

- 22.5% of the proceeds is distributed to the RARF for "major arterial streets, intersection improvements and regional transportation infrastructure, including capital expense and implementation studies"

- At least 33.5% of the proceeds is distributed to the Public Transportation Fund (PTF) for "capital costs, maintenance and operation of public transportation mode classifications"

- Up to 3.5% of the proceeds is distributed to the PTF for "capital rehabilitation costs associated with the light rail system"

Transit Fare-related targets

The bill, according to the legislative analysis, also requires Maricopa County to, by Fiscal Year 2032, recover 20% of its annual public transit operating costs via collection of transit fares, in what is known as farebox recovery.

For Fiscal Years 2027 and 2028, the ratio is set at 10%, and for Fiscal Years 2029 to 2031, the ratio is set at 15%.

In its financial report for the 2021-2022 Fiscal Year, the Valley Metro Regional Public Transportation Authority had a farebox recovery ratio of 11.1% for the 2018-2019 Fiscal Year. Figures for fiscal years of 2019-2020 and 2020-2021 were much lower, coming in at 6.5% and 0.8%, respectively.

It should be noted that according to the financial report for the 2019-2020 Fiscal Year, transit ridership dropped dramatically that fiscal year, to the tune of 18.4%, due to effects from the COVID-19 Pandemic. The drop was even steeper for the 2020-2021 Fiscal Year. The decline for that fiscal year, according to the corresponding financial report, was 47.4%.

Other Provisions

SB1102, according to the analysis, would also ban transportation tax revenues from, among other things, being used for any light rail, commuter rail, street car or trolley extension, or being used to "influence the outcome of an election."

The bill, according to the analysis, would also ban the state, as well as any cities, towns, counties, or political subdivision from restricting the use or sale of a vehicle in Arizona, if the restriction is based on the car's energy source. Government-owned vehicles, however, are excluded from the provision.

In addition, SB1102, according to the analysis, would set a minimum speed limit of 65MPH for all cars on interstate highways in Maricopa County, with exceptions.

You mentioned a deal that includes the repeal of the rental tax…

According to reports, the compromise for State Legislature Republicans for pushing SB1102 through was for Gov. Hobbs to agree to sign a bill she previously vetoed.

"A repeal of the rental tax, which is a property tax that renters pay or landlords pay, and it’s about $280 million to $300 million a year that cities use to fund largely public safety services," said Coughlin.

In February, we reported that Gov. Hobbs vetoed such a bill. At the time, Gov. Hobbs said the bill lacked any enforceable mechanism to ensure relief will be provided to renters, and that the bill includes a budget appropriation of about $270 million that exists outside of a comprehensive budget agreement.

Will cities be affected by a rental tax repeal?

According to a legislative analysis for the rental tax repeal bill that was vetoed by Gov. Hobbs, the bill may reduce municipal tax revenues by $75.3 million by Fiscal Year 2025, which would grow to $282.7 million by the 2029 Fiscal Year.

According to a March 2022 report by the Associated Press on a similar proposal, the rental tax repeal could mean big budget problems for some cities. In that report, a lobbyist for Prescott said with police and fire taking up a majority of the city budget and cuts there unpalatable, that means all other services would need to be cut by more than 25%.

"That’s difficult to do for a small community that has limited ability to raise additional or new resources, especially the imposition of new taxes," Barry Aarons said.

State Senate Republicans, however, would not let up on their goal to tie the rental tax repeal with the extension of Proposition 400.

"Reducing the cost of housing for Arizonans is something that we, as a Legislature, are very passionate about, and this arbitrary rental tax was in our sights to repeal from the beginning of session,." said a GOP lawmaker during a news conference on the bill on July 31.

What are officials saying about this bill?

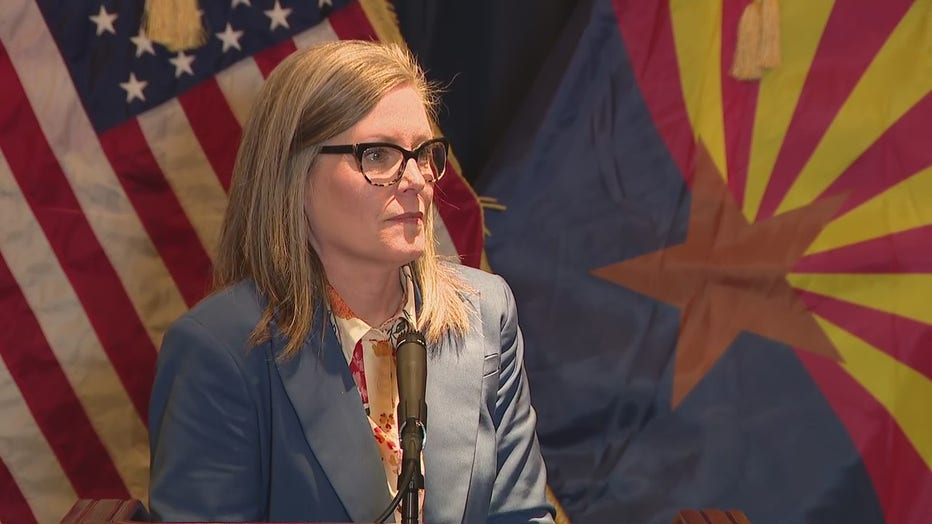

Arizona Governor Katie Hobbs

"Today, bipartisan leaders invested in the future of Arizona families, businesses, and communities. The passage of the Proposition 400 ballot measure will secure the economic future of our state and create hundreds of thousands of good-paying jobs for Arizonans. These critical infrastructure investments will build and attract businesses and make Arizona the best place to live, work, and raise a family. I am glad we were able to put politics aside and do what is right for Arizona. Together, we will build an Arizona for everyone."

Arizona Senate President Warren Petersen

"This latest 20-year Prop. 400 extension prioritizes maintenance and expansion of the critical highways and roads relied upon each day throughout Maricopa County for travel to work and school, as well as for tourism and commerce. The proposal also ensures any road projects funded by these dollars will be aimed at decreasing vehicle congestion and travel times, not unattainable environmental goals established by the radical left."

Phoenix Mayor Kate Gallego

"After months of negotiations, I am glad that our robust, unanimously approved transportation plan will finally reach the voters of Maricopa County. This legislation is how we will continue to support our region’s record growth, and with approval from our voters, its passage will ultimately mean that we can deliver on improved and expanded transit and transportation services that connect county residents to jobs, education, and more.

While it’s exciting that we’ve advanced Proposition 400, I remain disappointed that this critical legislation was coupled with an effort to cut revenue to cities, including Phoenix, as soon as in the next budget year. As such, I cannot and will not support any action that would take away the power of cities to levy a residential rental tax, as this revenue is how we fund public safety hiring, improvements to parks and preserves, and neighborhood public safety grants. If the legislature wishes to push forward attempts to effectively defund our police and firefighters, I strongly urge them to come to the table and discuss how they can help us recoup the lost funding."

Valley Metro

Valley Metro RPTA Board Chair Bill Stipp, who is also a member of the Goodyear City Council, released a statement that reads, in part:

"Over the last 40 years, across three separate votes, the people of Maricopa County continue to support investments in their regional transit system. They do so to maintain the economic vitality, health, safety and overall mobility of current and future generations in the fastest growing county in the U.S. Every day, Valley Metro moves more than 100,000 people to their jobs, school, and important lifeline services, like medical care and grocery store visits. Public transit eases traffic congestion, mitigates air quality concerns and creates economic opportunity for those using our system and the thousands of small and large businesses whose workforce relies on bus, rail and paratransit service. We thank our legislative leaders for their active discussions and listening to their constituents to advance this critical initiative to voters. We are grateful for the tremendous support and advocacy of Governor Hobbs, our local elected leaders and community partners for staying strong on the importance of a balanced transportation plan informed by the community and for the benefit of our entire region."

So, what's next?

Gov. Hobbs signed the bill on Aug. 10. If all goes according to plan, Proposition 400 will go before voters in Maricopa County voters.

The timeline for such a vote, according to SB1102's legislative analysis, is during a two-year period that starts four years before the existing Proposition 400 tax would be discontinued, and ends two years before the tax would be discontinued, which translates to Jan. 1, 2022 to Jan. 1, 2024.

In addition, the bill states that such an election is to take place one year before the existing transportation tax would be discontinued on Jan. 1, 2025.