The cost of COVID-19: Amid illness, Americans face heavy financial burden in testing and treatment

Uncovering the costs of COVID-19

A recent study by Avalere Health revealed the staggering average cost of COVID-19-related hospitalizations in the United States.

LOS ANGELES - Health care prices in the United States are unregulated and unpredictable. Add into the mix the magnitude of widespread illness America is facing amid a global pandemic paired with surging unemployment rates and a medical insurance system that is largely tied to employers.

The expenses associated with COVID-19 can cause bewilderment among those in dire need of medical attention. What are the costs if you are hospitalized with the virus? What is the price of getting tested? These common — and seemingly simple — questions can have varying and drastically different answers for Americans in similar situations.

A tale of two coronavirus tests

Hospitalizations and treatments can be costly for patients, but one would imagine that a simple test to find out if you have the coronavirus in the first place wouldn’t be so expensive. But, for some, that’s not the case.

The shared experience of two residents of Austin, Texas illustrates how frustrating, chaotic and expensive getting tested for COVID-19 in the U.S. can be.

Woman received an insurance claim for $6,400 for a COVID-19 test

Hospitalizations and treatments can be costly for patients, but one would imagine that a simple test to find out if you have the coronavirus in the first place wouldn’t be so expensive. But, for some, that’s not the case.

Pam LeBlanc and her friend Jimmy Harvey, who both live in Austin, decided to get tested for the novel coronavirus as a precautionary measure before embarking on a kayaking trip with friends.

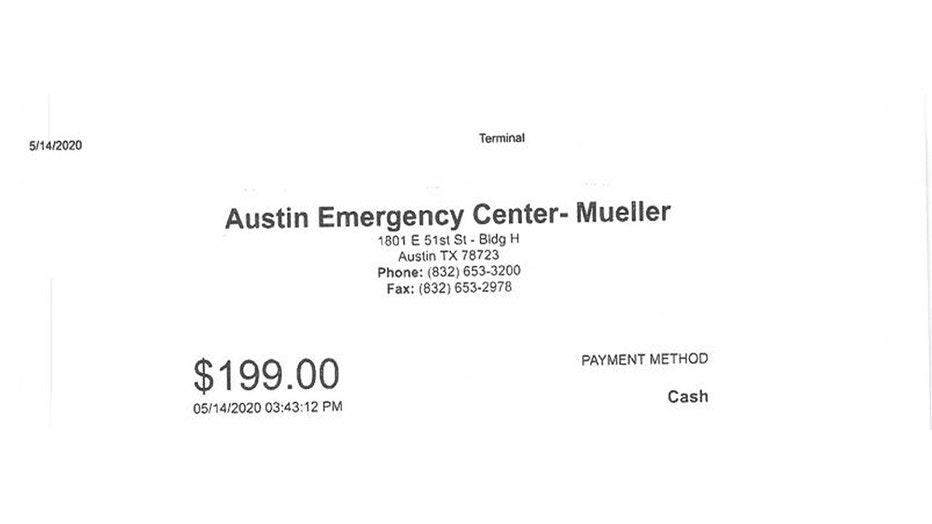

The two visited Austin Emergency Center (AEC), an out-of-network provider for a drive-through coronavirus test. Harvey said that paying out-of-pocket seemed more convenient than going through his insurance, so he paid $199 cash.

But LeBlanc assumed it would make more sense for her to use her medical insurance. She received a claim letter from her insurance company a few weeks later for approximately $6,400.

Jimmy Harvey’s bill for his coronavirus test from Austin Emergency Center.

The friends chose AEC because at the time, it was difficult to find a place to get a COVID-19 test, and LeBlanc said that her primary care provider “didn’t answer the phone” when she called. Due to the lack of widespread availability in testing at the time, the two friends expected to pay some money out of pocket, especially since they did not have symptoms.

Fortunately, their tests came back negative, but the bill that came back to LeBlanc left her reeling.

LeBlanc, a local journalist covering the outdoors, thought she was simply doing the right thing when her she decided to get tested.

During testing, she noted that she never got out of her vehicle — recalling the unpleasant experience of a long nasal swab being shoved up her nose, which she sarcastically said was “really fun.”

LeBlanc was tested on May 15, and received the claim statement from her insurance company around the first week of June. Despite her test being simple and straightforward, LeBlanc was alarmed to see an array of anomalous charges that did not make any sense to her.

“Seriously, more than $6,000 for a drive-thru COVID test, something isn’t right about that,” said LeBlanc. “You go into it trying to do the right thing and you feel like you kinda got screwed over.”

When asked why she thought using her medical insurance rendered a bill that was astronomically higher than her friend who paid cash, LeBlanc responded, “It makes no sense to me.”

Austin Emergency Center said that in an attempt to help individuals with no health insurance, they decided to charge patients a base rate, which explains Harvey’s bill of $199.

“At the beginning of this pandemic, our company made a decision to help individuals who do not have health insurance be able to get a COVID-19 test. In these cases, we charge the patients a minimal cost (lab reagents, transport, etc.), with no charge for the cost of seeing the ER provider or any of the other costs associated with an ER visit,” an AEC spokesperson said.

LeBlanc noted four major documents from her insurance claim consisting of all the charges following her visit to the clinic. Two were from AEC, while the other two were from Genesis Laboratory, where the clinic sent the tests.

Some of the confusing charges included a herpes test, as well as an infectious blood culture test. There was also a test for Legionnaires’ disease. All of the tests were billed by Genesis Labs, which raised red flags for LeBlanc.

“I never had a drop of blood drawn,” added LeBlanc.

LeBlanc said that these same extra charges for tests were found on the insurance claims belonging to friends of hers who visited the same drive-through test site from the same provider.

When asked about the tests that LeBlanc was billed for, Austin Emergency Center said, “We cannot comment on specific patients, but we can say that we have had at least one patient recently, for whom a blood culture was wrongly coded by their insurance company, and which has since been corrected.”

“Our company does not draw blood for COVID testing. Our company also does not designate the specific conditions that are tested for within the COVID panel. The lab where we initially sent our COVID tests makes that determination. In cases like what you’re referring to, it was Genesis Labs who made the determination (who we are no longer partnered with). Genesis Labs has a pre-defined set of conditions they test for, which they can test for as part of the panel we send them,” a spokesperson for AEC said.

The spokesperson said that when the medical center became aware of the exorbitant fees from Genesis Labs, they immediately sought a new lab to partner with.

LeBlanc was told by her health insurance provider UnitedHealthcare that the claim she received would not be the final bill.

UnitedHealthcare said it is "waiving cost share for COVID-19 related testing and informed Ms. LeBlanc that she will not have to pay the cost share associated with the COVID-specific test."

"In addition to investigating this center’s billing practices, we are conducting a broader review of egregious – and perhaps fraudulent – provider billing, particularly as it relates to free-standing emergency departments and COVID testing-related visits," according to the company.

She said that while she expected her medical bill to be a little more expensive than usual because she visited an out-of-network provider with AEC, she was shocked to see some of the expenses charged from the hospital itself.

She was charged $2,122 for “emergency services,” which seemed ridiculous to her considering she never got out of her car while taking the test.

Photocopy of the various charges found on Pam LeBlanc’s medical insurance claim after her COVID-19 test. (Pam LeBlanc)

“I understand that they have to pay to staff the facility and keep it open, but $2,100 in emergency services is outrageous,” said LeBlanc.

She added that while she was only going to be charged just over $1,000 out-of-pocket, that much alone — along with how much her insurance company would be charged — seemed nonsensical.

Austin Medical Center commented on the high costs associated with LeBlanc’s visit to their facility, saying that “major insurance carriers have agreed to cover the cost of COVID-19 testing for patients, without assigning a patient responsibility.”

“We feel strongly that we have a responsibility to our community to serve all patients who come to our emergency centers seeking emergency medical care. Providing the best customer and patient care is our top priority. We understand these are challenging times for everyone, and it is our commitment to ensure every patient’s experience is fulfilled to the best of our ability,” a hospital spokesperson said.

LeBlanc said that the whole experience has made her more cautious when visiting a hospital for something as simple as a coronavirus test. She hopes her story will be a cautionary testament to the troubles plaguing coronavirus testing in the U.S. and the country’s health care system in general.

“I hesitate to say it was so-in-so’s fault, it’s a problem with the health care system we have. Somebody screwed up. I don’t know who it is, maybe it was some honest mistakes in there but the end result is if I hadn’t noticed it in the claim that was sent to my insurance company, the insurance company would’ve been billed for all this stuff, and it probably happens over and over and over,” said LeBlanc.

“It’s discouraging people from getting tested,” added LeBlanc. “If it happened to me and it happened to my friends, then we’re not the only ones,” she said.

A spokesperson for Austin Emergency Center said the hospital did not receive any funds from the CARES act to help cover the costs of coronavirus patients.

The average cost of COVID-19 hospitalization

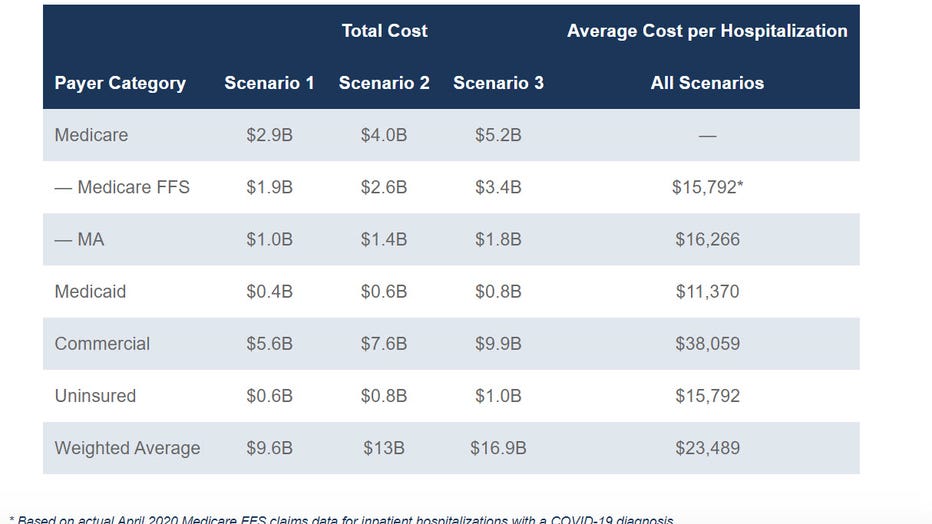

A recent study by Avalere Health revealed the staggering average cost of COVID-19-related hospitalizations in the United States.

According to the study, hospitalizations have increased significantly, totaling an estimated 293,000 between March and May of 2020.

The company projected that a typical hospital stay for U.S. coronavirus patients was $23,489, with an average of nine days in the hospital. “That varies pretty dramatically depending on what coverage you have,” Chris Sloan, associate principal at Avalere Health, said

Avalere’s analysis, which collected a sample of hospital stay claims, found that total costs to the U.S. health care system from inpatient hospitalizations due to the coronavirus will range from $9.6 billion to $16.9 billion in 2020.

RELATED: CoronavirusNOW.com, FOX launches national hub for COVID-19 news and updates

Total and average hospitalization costs for COVID-19 patients by payer.

Avalere studied the “average patient,” which ranged from healthy individuals to those with pre-existing conditions.

Individuals who required ventilation had hospital costs that averaged three times as much — $31,174 — in comparison to non-ventilated patients at $12,140.

In a study published in April by the CUNY Graduate School of Public Health and Health Policy, researchers found that if 20% of the U.S. population were to become infected with the novel coronavirus, it could result in 1.6 million ventilators being used, costing an average of $163.4 billion.

It was reported in July that Americans sick with COVID-19 currently represent 25% of all the world’s coronavirus cases — a staggering disparity that health experts are warning could soon overwhelm the capacity of the U.S. health care system.

“If 50 percent of the U.S. population were to get infected with the COVID-19 coronavirus, there would be 27.9 million hospitalizations, 4.1 million ventilators used and 156.2 million hospital bed days accrued, costing an average of $408.8 billion in direct medical costs during the course of the infection,” according to the study’s authors.

Researchers argued that the current supply of available ventilators and ICU beds will not be not sufficient if 20% of Americans are in need of them.

And while the prospect of a more than $30,000 ventilator bill likely appears alarming to the average American, Sloan said it’s not that surprising. “It is expensive to spend a long time in the hospital in the United States. If you think about — the average length of stay for us is nine days in our data for someone who has COVID and is admitted to the hospital. That’s a lot of money, takes a lot of work to monitor a patient around the clock, provide them care, keep them in that bed for nine days on average.”

With over 30 million Americans who have filed for unemployment, Sloan said the costs could cause individuals who feel they don’t have the means to pay to avoid getting care. “It’s really hard to decide to seek out care if you don’t know how much it’s going to cost,” Sloan said.

The prohibitive price of coronavirus treatment

Hospitalizations can be costly, but what is the average price of current treatments for the novel coronavirus in the United States?

On June 29, Gilead Sciences Inc. announced its pricing plans for the coronavirus drug Remdesivir — the most promising drug shown to treat COVID-19 thus far. The company said it will charge hospitals $3,120 for a course of treatment for a patient in the U.S . with private insurance.

“There is no playbook for how to price a new medicine in a pandemic,” Daniel O’ Day, chairman & CEO of Gilead Sciences, said in an open letter. “We approached this with the aim of helping as many patients as possible, as quickly as possible and in the most responsible way.”

The drugmaker announced the price would be set to $390 per vial for governments of developed countries. But because of “the way the U.S. system is set up and the discounts that government health care programs expect,” the price would be adjusted to $520 per vial for U.S. private insurance companies.

RELATED: 'People are willing to play Russian roulette with their family’s lives': Doctor slams behavior in US

Gilead said it believes that its pricing is well below value. O’Day wrote, “We started with our immediate responsibility to ensure price is in no way a hindrance to ensuring rapid and broad treatment.”

Uninsured individuals can be covered under provisions of the CARES Act. The $2 trillion legislation that was signed into law on March 27 allocated $175 billion in relief funds to health care providers to ensure that patients would not be sent “surprise medical bills” after being treated for COVID-19.

The HRSA Covid-19 Claims Reimbursement program provides claims reimbursement to health care providers who are providing treatment for uninsured individuals. But the program will only provide reimbursement when “COVID-19 is the primary reason for treatment,” the spokesperson said.

Surprise bills typically happen when a patient with health insurance gets treated at an out-of-network emergency room, or when an out-of-network doctor assists with a hospital procedure. The bills can run from hundreds of dollars to tens of thousands. Before the coronavirus outbreak, lawmakers in Congress had pledged to curtail the practice, but prospects for such legislation now seem uncertain.

“President Trump is committed to ending surprise bills for patients,” the Department of Health & Human Services wrote in a statement. “As part of this commitment, as a condition to receiving these funds, providers must agree not to seek collection of out-of-pocket payments from a presumptive or actual COVID-19 patient that are greater than what the patient would have otherwise been required to pay if the care had been provided by an in-network provider.”

The financial toll of not getting better

Potentially devastating out-of-pocket coronavirus expenses, for some, don’t end with testing and treatment.

Hanna Lockman, a Louisville, Kentucky resident, first noticed her coronavirus-like symptoms in March and has experienced lasting negative effects to her health ever since — and the bills keep piling up.

Lockman said she has been hospitalized three times, racking up 13 emergency room visits over the course of her illness, eventually maxing out her deductible in May.

“I just calculated the cost of my charges so far and the total – if I didn’t have insurance — would be over $180,000,” she said. “I maxed out my insurance for the year around the first week of May, so thankfully everything since then has been covered at 100%. However, maxing out my insurance means spending $7,900.”

Lockman is among a growing number of people who can be found in various support groups that have emerged on Facebook consisting of thousands of members calling themselves “long haul survivors,” reporting COVID-19 symptoms that they say have lasted for months.

RELATED: ‘Today is day 93’: People report experiencing COVID-19 symptoms that last for months

A Columbia University epidemiologist describes some of the long-term effects of COVID-19

Dr. Mady Hornig has been confronted with an array of concerning symptoms that have persisted in patients, as well as herself.

Since getting sick, Lockman has experienced an array of anomalous conditions ranging from blood clots to heart issues that force her to wear a heart monitor, contributing to growing costs and medical visits that don’t appear to have an end date.

She said the disease hit her like a ton of bricks and while her initial fears brought her to conclude that she had come down with the flu, she tested negative for that, eventually leading doctors to treat her for pneumonia, which she had never contracted before.

Considering the timing of her illness, she was convinced it was COVID-19, and despite asking to be tested, she said doctors refused.

Lockman said she pressed her doctors for a coronavirus test and was continuously told no. “I thought I was crazy,” she said. “There is a pandemic going on and you will not test me for a pandemic virus.”

“It was a very weird feeling being refused a test and having to fight with doctors. I’ve never had that experience,” Lockman recalled.

Norton Healthcare System, where Lockman said she was treated, did not immediately respond to a request for comment.

Lockman eventually received a test three weeks after her symptoms first began, which came back negative. Lockman added that her doctor said the test was most likely a “false negative.”

But according to Lockman, all that mattered to her insurance company was the negative result, which rendered her ineligible for benefits under the CARES act and unable to be covered for any treatments related to the coronavirus.

This, despite there being multiple reports and documented cases of faulty testing in the United States.

On July 8, The U.S. Food and Drug Administration issued a warning letter for clinical labs and health care providers over COVID-19 tests manufactured by global medical technology company Becton, Dickinson and Company (BD) which has produced coronavirus tests the department says are at high risk for false positive results.

In a study conducted by the company and cited by the FDA, approximately 3% of results from tests using the BD SARS-CoV-2 Reagents for the BD Max System were false positives.

Pandemic profiteers

On July 1, 10 companies, including Genesis Labs, received a letter from Energy and Commerce Committee Chairman Rep. Frank Pallone, Jr. (D-N.J.) requesting information about their practices and prices regarding potential COVID-19 test price gouging. according to a press release from the office of Pallone.

“The Committee has been informed of troubling instances in which providers are charging up to $6,000 for one COVID-19 test. In a number of instances identified to the Committee, providers are charging prices for diagnostic tests to detect COVID-19 that range from $300 to $6,000,” according to the release.

“I am deeply concerned about reports that some patients are receiving surprise bills for hundreds and even thousands of dollars for out-of-network laboratory charges for COVID-19 testing,” wrote Pallone.

Genesis Labs did not immediately respond for comment.

In March, The United States Department of Justice announced its intention to go after criminals looking to take advantage of the coronavirus crisis by fixing prices, and rigging bids for personal health equipment during the COVID-19 outbreak.

“The Department of Justice stands ready to make sure that bad actors do not take advantage of emergency response efforts, healthcare providers, or the American people during this crucial time,” Attorney General William Barr said in a news release. “I am committed to ensuring that the department’s resources are available to combat any wrongdoing and protect the public.”

RELATED: Coronavirus: DOJ issues warning over price gouging

Since then, the federal government has warned the public of various scams related to the ongoing health crisis, in which some critical supplies have become the subject of mass shortages following a barrage of panic buying that erupted when the virus first began to spread across the country.

7 ways to keep your finances strong amid the COVID-19 pandemic

Adjusting your budget and minimizing credit card debt are essential.

In late June, A Department of Veterans Affairs respiratory therapist was charged with stealing medical supplies used to treat patients with COVID-19 and selling them on eBay, according to a news release by the U.S. Department of Justice.

Gene Wamsley, 41, allegedly stole respiratory support equipment from the Veterans Affairs Medical Center in Washington and was formally charged by the U.S. District Court in Seattle on June 17.

An investigation into Wamsley began in January 2020 after two VAMC staff members reported several bronchoscopes missing from the hospital that were later found listed for sale on eBay from a seller in Bonney Lake, Washington. Three ventilators were also found missing from the same hospital during the same time period.

While it became common place for government organizations to crackdown on the illegal hoarding and price gouging of key medical supplies such as hand sanitizer or even respirators like the ones sold by Wamsley, these scams also seemed to extend to false therapies as well.

In early April, The U.S. Food and Drug Administration issued a warning for a church selling chlorine dioxide products known as “Miracle Mineral Solution” (MMS) claiming to be used as treatment for COVID-19.

The FDA alleged that the Genesis II Church of Health and Healing has previously been warned for selling the product, which the agency says is a powerful bleaching agent and have been known to cause serious life-threatening adverse effects to those who drink it.

“Chlorine dioxide products have not been shown to be safe and effective for any use, including COVID-19, but these products continue to be sold as a remedy for treating autism, cancer, HIV/AIDS, hepatitis and flu, among other conditions, despite their harmful effects,” the FDA said in a news release.

The Associated Press contributed to this story.