5 New Year's financial resolutions for beginners to build better money habits in 2022

If your goal is to build better spending habits next year, consider these tips to meet your short-term and long-term goals. (iStock)

The new year offers a fresh start, especially following an unpredictable 2021 that impacted the finances of Americans in a number of ways. Record-high inflation impacted shoppers at the gas pump and the grocery store, and supply chain issues made it more expensive than ever to purchase certain goods like new vehicles and furniture.

Mercifully, interest rates were near historic lows for a significant portion of the year, giving U.S. consumers the opportunity to combat rising prices. If you're looking to build better money habits in 2022, consider the following financial New Year's resolutions:

- Make a budget and track your progress

- Take control of high-interest credit cards

- Monitor and improve your credit score

- Make a plan for your student loan debt

- Save money on interest with mortgage refinancing

Read more about each New Year's resolution in the sections below, and visit Credible to compare offers on a number of products to help you reach your financial goals.

FREE CREDIT REPORTS HAVE BEEN EXTENDED; HERE’S WHY IT’S IMPORTANT TO CHECK YOURS REGULARLY

1. Make a budget and track your progress

Creating a monthly household budget can give you insight into your spending priorities and help you change your money habits to better suit your financial goals. A good place to start is to follow the 50/30/20 budget rule:

- 50% of your income should go toward necessary expenses like a housing payment, utilities, groceries and child care.

- 30% of your income should go toward discretionary spending like entertainment, dining out at a restaurant and concert tickets.

- 20% of your income should go toward savings and debt repayment.

Long gone are the days of combing through paper bank statements to monitor your budget. There are plenty of free budget apps available on your smartphone like Mint, PocketGuard and Personal Capital that can help you start budgeting and automatically track spending by connecting to your bank accounts.

HOW TO GROW YOUR RETIREMENT SAVINGS WITH MINIMAL RISK

2. Take control of high-interest credit cards

Making the minimum payment on your credit card balances is a quick way to rack up expensive debt. Credit card interest rates are near all-time highs at 17.13%, according to the Federal Reserve.

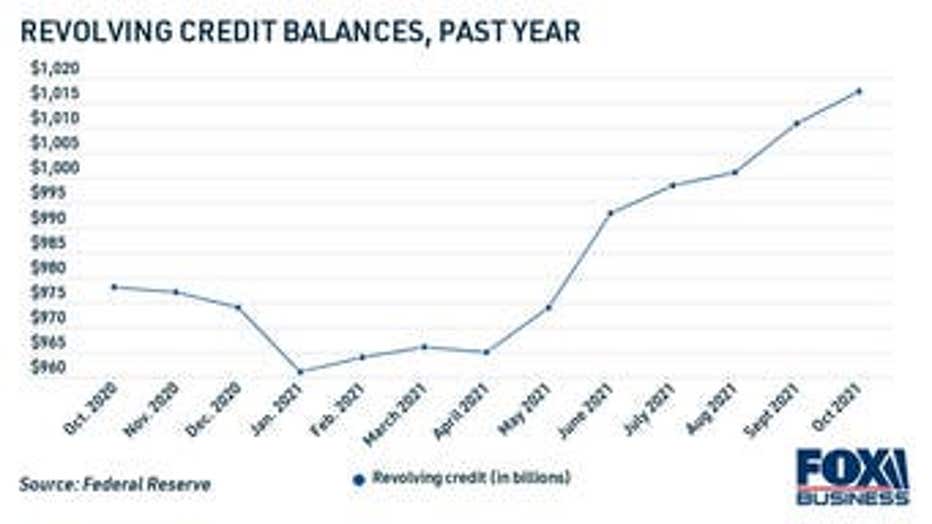

Ideally, you should be able to pay off the entire statement balance on your credit cards each month to avoid paying interest entirely. But the reality is that revolving credit balances have been skyrocketing for the past year, which means consumers are relying on high-interest credit card debt to make ends meet.

HOW LONG DO NEGATIVE ITEMS STAY ON YOUR CREDIT REPORT?

If you're struggling to manage your credit card debt, consider the following debt repayment strategies:

Debt avalanche method. This is a financial strategy in which you pay off the credit card with the highest interest rate first in order to save the most money while you get out of debt. Alternatively, the debt snowball method is when you pay off the card with the smallest balance first to gain momentum.

Balance-transfer card. Consumers with good credit can consider taking out a balance-transfer credit card with a lower interest rate to pay off their debt on better terms. Some credit cards offer an introductory 0% APR period, effectively allowing you to repay your credit card debt during a set period of months without paying interest. Keep in mind that you may have to pay a balance transfer fee of about 3-5% of the total amount. Visit Credible to compare balance-transfer offers for free.

Debt consolidation loan. This is a type of unsecured, lump-sum personal loan that allows you to repay your high-interest credit card debt in fixed monthly payments over a set period of time at a lower interest rate. Personal loan interest rates are near all-time lows at 9.39%, according to the Fed. You can view debt consolidation loan interest rates without impacting your credit score on Credible.

Bonus tip: Contribute to your emergency fund, so you can avoid becoming dependent on credit cards to cover unexpected expenses. Most experts agree that your emergency savings should cover between 3 and 6 months' worth of expenses.

CAN YOU BORROW FROM AN INDIVIDUAL RETIREMENT ACCOUNT (IRA) WITHOUT PENALTY?

3. Monitor and improve your credit score

Having a high credit score can help you lock in the best offers when borrowing all types of credit, from mortgages to student loans. Good credit may also be necessary to lease an apartment, buy a car and secure reasonable insurance rates.

Credit monitoring is a crucial part of establishing a robust credit history because it can alert you to fraudulent activity and spending before it spirals out of control. Plus, credit monitoring can help you determine where you can improve your credit score, such as lowering your credit utilization ratio or improving your on-time payment history.

You can enroll in free credit monitoring services through Credible.

ENROLLING IN A HIGH-YIELD SAVINGS ACCOUNT: A STEP-BY-STEP GUIDE

4. Make a plan for your student loan debt

Student loan debt is a heavy financial burden for many young consumers. More than 43 million Americans owe student loan debt with an average balance of $39,351, according to the Education Data Initiative. In fact, 1 in 3 millennials said in a survey that student loans are preventing them from buying a home.

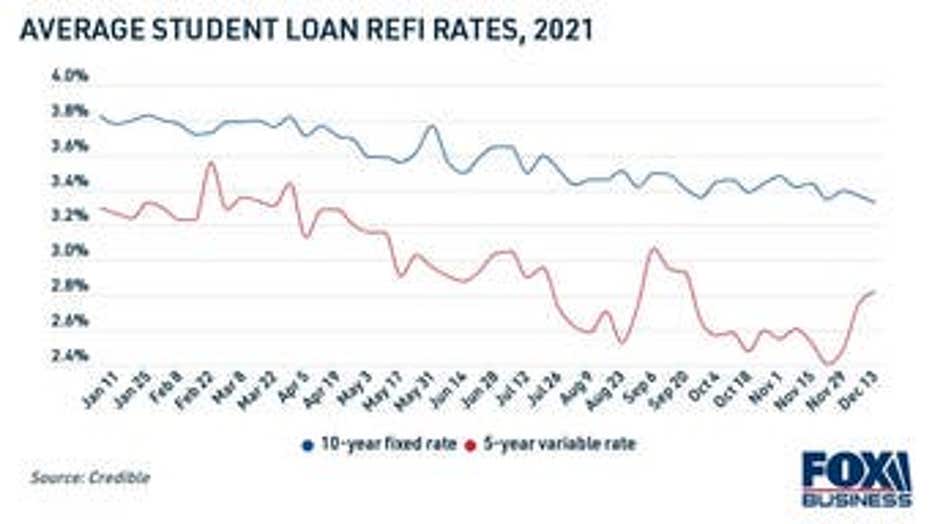

One way to manage your student loan repayment is by refinancing to a lower interest rate. Fixed student loan refinance rates are at record lows, according to data from Credible, which means that borrowers have the opportunity to save more money than ever.

Student loan refinancing may help you reduce your monthly payments, pay off your debt faster and save money on interest over the life of the loan. Borrowers who refinanced to a shorter loan term on Credible were able to save nearly $17,000 on their student loan debt.

Keep in mind that refinancing your federal student loans into a private loan will make you ineligible for government protections like income-driven repayment plans, COVID-19 administrative forbearance and select student loan forgiveness programs.

You can browse student loan refinance rates from private lenders in the table below, and visit Credible to see your estimated rate for free without impacting your credit score.

HOW A MORTGAGE REFINANCE AFFECTS YOUR NET WORTH

5. Save money on interest with mortgage refinancing

A recent study from Zillow found that homeowners stand to miss out on the opportunity to save more than $300 on their monthly mortgage payments by not refinancing.

That's because mortgage rates reached historic lows in 2021, according to Freddie Mac. In January, the average rate for a 30-year mortgage was 2.65%. The rate for the 15-year mortgage term, which is popular among homeowners who are refinancing, set a record low of 2.10% in July.

Although mortgage rates have risen since then, many homeowners still stand to benefit by refinancing to a lower rate than what they're paying on their current mortgage. And with the Federal Reserve projecting up to three rate hikes in 2022, it's important to act sooner rather than later before mortgage rates rise further.

If you're considering refinancing your mortgage to save money, visit Credible to compare mortgage refinancing offers across multiple lenders. That way, you can lock in the lowest rate possible for your financial situation.

GETTING LIFE INSURANCE WHILE YOU'RE YOUNG AND HEALTHY CAN SAVE YOU THOUSANDS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.