This is the average student loan debt in every state

New data from The Institute for College Access & Success shows where the class of 2020 has the highest student loan debt balances. (iStock)

A college degree gives graduates the opportunity to secure higher-paying jobs in specialized fields, but it can come with a high price tag that leaves many Americans with crushing student loan payments. For borrowers in some U.S. states, the debt burden is even greater.

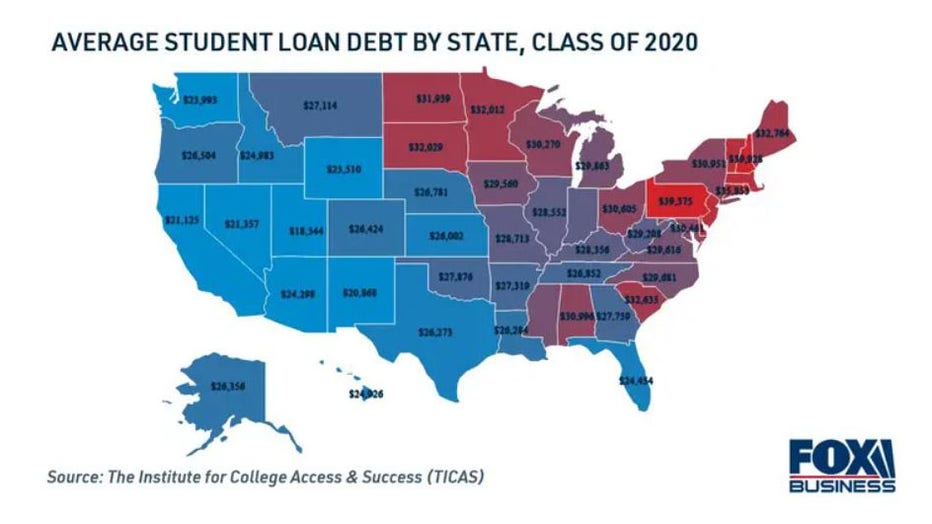

The average student loan debt among the class of 2020 ranges from $18,350 in Utah to $39,950 in New Hampshire, according to a new report by The Institute for College Access & Success (TICAS). The map below shows the average student loan balance among bachelor's degree recipients in each state.

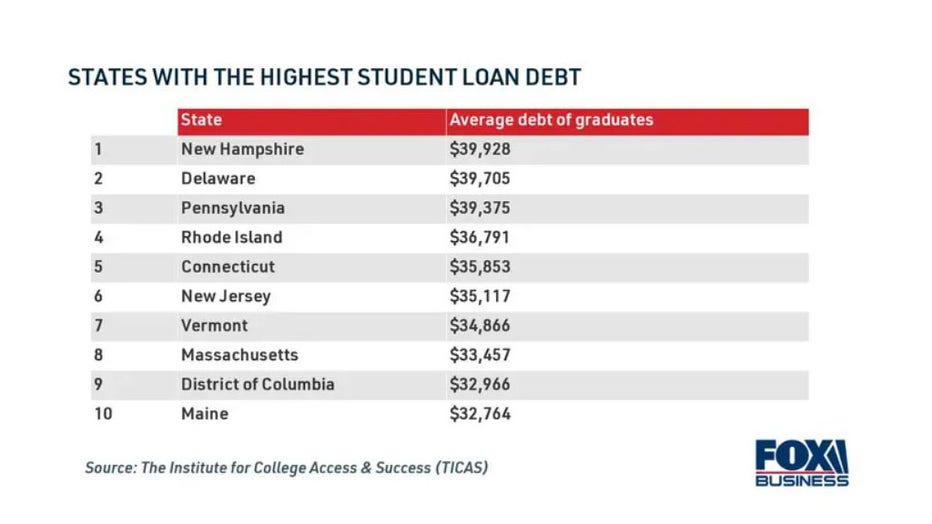

The average debt upon graduation was more than $30,000 in 19 states, and it exceeded $35,000 in six states: New Hampshire ($39,928), Delaware ($39,705), Pennsylvania ($39,375), Rhode Island ($36,791), Connecticut ($35,853) and New Jersey ($35,117).

"Despite flattening levels of student loan debt in recent years, the debt of graduating classes has remained near an all-time high, and the debt borrowers hold continues to make their lives financially perilous," said TICAS President Sameer Gadkaree.

Keep reading to learn more about where borrowers have the highest and lowest student loan debt balances, as well as alternative student loan repayment options like refinancing. You can compare student loan refinance rates across multiple private lenders on Credible's online marketplace.

7 IN 10 PARENTS SPENT MORE ON COLLEGE TUITION AND FEES THAN THEY EXPECTED

Where borrowers have the most student loan debt

Graduates in New Hampshire, Delaware and Pennsylvania have the highest average student loan debt — in all three states, the average student loan balance upon graduation exceeds $39,000. Of the top 10 states with the highest student loan debt balances, all of them are in the New England or mid-Atlantic regions of the Northeast.

Generally, student loan borrowers in the Northeast have more student loan debt than those who live in Southern and Western states. There are a few exceptions, though, with some borrowers in the Midwest and the South graduating with high levels of debt:

- No. 11 South Carolina ($32,635)

- No. 12 South Dakota ($32,029)

- No. 13 Minnesota ($32,012)

- No. 14 North Dakota ($31,939)

- No. 15 Alabama ($30,996)

In many of the states with elevated student loan balances, the total cost of attending a four-year public or nonprofit institution is higher. The average cost of college in Massachusetts is $53,853, which is still much more expensive than in New Hampshire ($45,393), the state with the highest average debt balance. In New York, the total cost of attendance is $46,955 — but borrowers have just $30,951 worth of debt on average.

In the District of Columbia, which has the ninth-highest student loan debt balances, the cost of college is the most expensive at $64,354. That's nearly double the average student debt amount in the nation's capital, suggesting that many D.C. students rely on financing methods besides loans to pay for college.

If you're looking for ways to repay high amounts of student loan debt, consider refinancing while student loan interest rates are near record lows. You can browse current student loan refinance rates in the table below, and visit Credible to see your estimated interest rate for free without impacting your credit score.

HOW CAN BORROWERS RECOVER FROM STUDENT LOAN DEFAULT?

Where borrowers have the least student loan debt

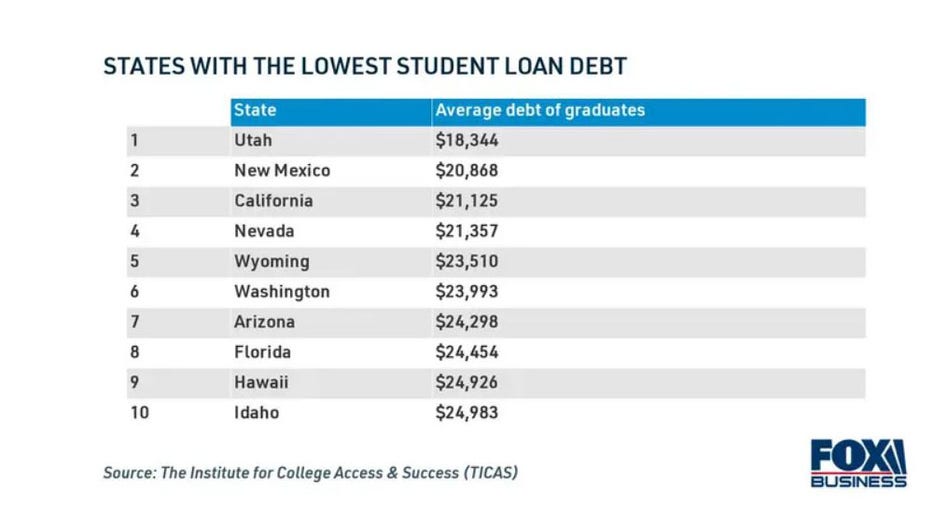

Graduates in some states are fortunate to have lower amounts of student loan debt when compared to the national average. Still, No. 1 Utah is the only state to have an average student loan debt below $20,000.

Almost every state where graduates have low student loan balances is located in the American West. Student loan borrowers in New Mexico ($20,868), California ($21,125), Nevada ($21,357), Wyoming ($23,510) and Washington ($23,993) have much more manageable levels of debt than those who live in Northeastern states.

The total cost of college tends to be cheaper in states with lower levels of student loan debt. In Utah, the state with the least student loan debt per borrower, the average cost of obtaining a college degree is $20,769. There are two states where the cost of college is below $20,000: Wyoming ($19,960) and Idaho ($19,296).

In some states, the average student loan balance exceeds the total cost of college. This is likely because there are hidden college expenses, such as rent and food costs, that may require students to borrow extra money to complete their education. If you borrowed more student loan debt than you can repay and are considering refinancing for better terms, use Credible's student loan refinance calculator to see your potential savings.

THIS IS THE STATE WHERE STUDENT LOAN BORROWERS ARE AT THE HIGHEST RISK OF DELINQUENCY

Strategies for repaying your student loans

Even among the states with the lowest amounts of student debt, repaying these loans can be difficult. If you're struggling to repay student loans, consider the following options:

- Enroll in an income-driven repayment plan (IDR), which limits your monthly federal student loan payments to 10-20% of your disposable income. You can learn more about IDR plans on the Federal Student Aid website.

- Work for a company that offers student loan repayment assistance. About two in five large companies plan on offering this benefit in the next two years, according to the Employee Benefit Research Institute.

- Refinance to a private student loan at a lower interest rate. Student loan refinancing may be able to help you reduce your monthly payments, get out of debt faster and save money on interest charges over time.

It's important to note that refinancing your federal student loan debt into a private loan will make you ineligible for government protections, such as COVID-19 emergency forbearance, IDR plans and select student loan forgiveness programs like Public Service Loan Forgiveness (PSLF).

You can learn more about student loan refinancing by getting in touch with a knowledgeable loan expert at Credible who can help you decide if this debt repayment strategy is right for your circumstances.

MILLIONS OF AMERICANS FEAR MISSING DEBT PAYMENTS: FEDERAL RESERVE BANK OF NEW YORK

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.