Why are some people still using checks? Here's what to know as Target stops accepting them

A Target store (Eric Thayer/Bloomberg via Getty Images)

PHOENIX - A decision by a major U.S. retailer on what kind of payments they will accept has sparked a debate over checks.

On July 8, Target announced that it will no longer accept personal checks as a form of payment, beginning on July 15. A spokesperson said the decision was made due to "extremely low volumes."

Here's what to know about checks, and what it is still being used for these days.

What are checks?

According to the Cornell Law School's Legal Information Institute, a check is a draft on an account that is used to instruct a bank or a financial institution to transfer money from the payer to the payee.

On their website, Remitly lists some of the different kinds of checks that exist in the world. Some of the more common ones include:

- Cashier's Check

- Certified Check

- Personal Check

- Traveler's Check

How did checks become a form of payment?

A check from the 1990s (Photo by Fairfax Media via Getty Images)

Based on an article published by the Federal Reserve Bank of Atlanta Economic Review in 2008, checks can trace their roots to at least the early 11th century in what is now Basra, Iraq, where a form of payment known as sakk allowed merchants to give written instructions to their bank for payments.

Around the year 1400, checks began to appear in Europe, and by the 15th century, they were adopted by England, and subsequent restrictions on banknotes led to an increase in the prominence of checks.

In the U.S., the article states that checks were a purely local form of payment up until the Civil War, when various improvements resulted in lower costs for check payments, which resulted in checks becoming a favored form of long-distance payment.

Are checks still a popular form of payment?

The article published by the Federal Reserve Bank of Atlanta Economic Review in 2008 states that the number of checks written in the U.S. peaked in the mid-1990s.

In 2023, the Federal Reserve Bank of Atlanta noted that in 2021, the U.S. wrote about 30 checks per capita, but about half of the checks used are estimated to be written by businesses, meaning the average American consumer wrote about 15 checks per year.

An article published by the American Bankers Association Banking Journal in May 2024 states that in 2021, the volume of checks written was 11.2 billion.

Why are Americans still using checks?

The ABA Banking Journal article states that checks are still the "easiest way to transfer a large amount of money for no added fee."

"The recipient pays no interchange, as it would with a debit or credit card, and customers aren’t limited to transaction amount caps banks often have for card and other transactions," a portion of the article states.

Businesses, per the article, also enjoy the benefit of a "float" in money between when a check is written and when a check is settled.

"When a business customer writes a check, it’s not going to clear immediately. They still have access to those funds, so that’s still a clear benefit in the eyes of both business and consumer customers," said D.J. Seeterlin, chief innovation and strategy officer at Chesapeake Bank in Kilmarnock, Virginia.

What are people still using checks for?

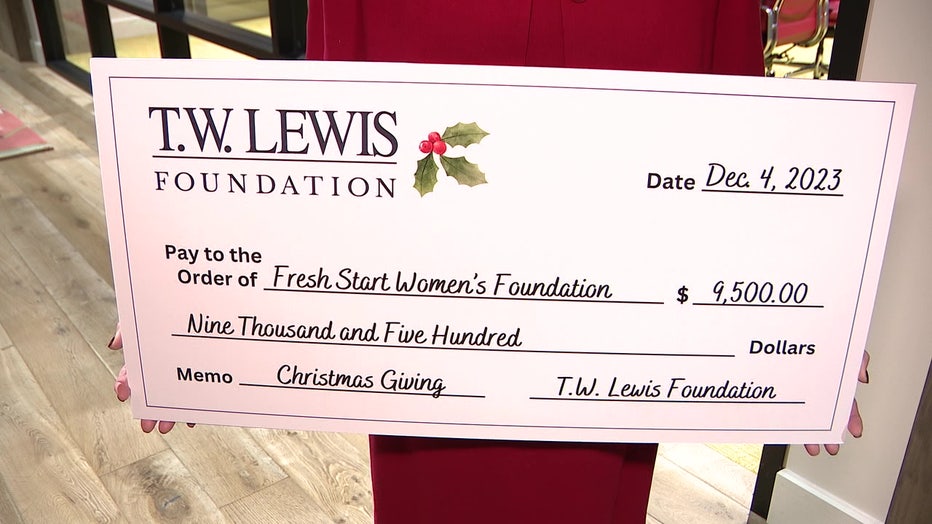

A big printout of a check, as used in a check presentation ceremony (From Archive)

On their website, Fifth Third Bank says that there are still a number of circumstances where someone may be required to use checks.

"Certain payments are likely to be better suited to checks over digital payment alternatives, especially for people with spotty internet access. The most common transactions involving checks are for rent, utilities, taxes and other payments to the government, payments to contractors, gifts to charities, payments for healthcare, and education expenses such as tuition payments," the article reads.

In addition, the website states that "many people also still use checks instead of cash to give monetary gifts."

"It’s a more secure form of payment, especially if mailing a card. In addition, it’s more convenient for the recipient since they can use a mobile check deposit feature on their smartphone to immediately add the funds to their bank account. If the gift had been cash, they would have to physically deposit the money at a bank branch or ATM," read a portion of the website.

Another use for checks is for setting up direct deposit for paychecks or government-issued benefits, according to Experian.

Checks still form a part of culture in the U.S. and some countries, in the form of a check presentation ceremony for certain events involving charitable donations. For those occasions, the ‘check’ being presented is oftentimes a big printout that is many times the size of a normal check.

What's an alternative to writing checks?

Cash, in United States Dollar (From Archive)

Cash, in certain situations, can be an alternative to checks. While there are some establishments that do not take cash, AARP officials say certain U.S. states and cities have enacted laws in recent years to make sure consumers, in most instances, can pay with cash.

Meanwhile, The College Investor listed a number of alternatives to checks, including:

- Online bill pay

- PayPal

- Venmo

- Zelle

- Bank wire transfer or intra-bank transfer

This article is for informational purposes only, and should not be considered as a substitute for professional financial advice. Please consult with your financial planner or a reputable financial expert if you have any specific questions related to your personal finance.