DES asking some to pay back unemployment money they received, but there is a solution: here's what to know

DES offering solution for unemployment overpayment

We have reported, on multiple occasions, on people who owed the Arizona Department of Economic Security money due to an overpayment of unemployment money. Now, there's a way to get the debt waived, but there is a catch. FOX 10's Steve Nielsen reports.

PHOENIX - I recent years, people have heard about thousands of Arizonans being forced to pay back unemployment despite doing nothing wrong.

After startling numbers revealed last month on the millions the state is seeking, an Arizona Senator is getting involved and trying to help those who need it.

Here's what you should know about the situation.

Why are people being made to pay back their unemployment money?

"If benefits have been paid and the claimant is later found not eligible, the Deputy issues a Determination of Deputy on the facts surrounding the existence of an overpayment and the cause such as fraud, non-fraud, or administrative. This decision will result in a subsequent Determination of Overpayment," read a portion of the website.

Why are there different categories of overpayments?

According to Arizona Department of Economic Security's website, the categories describe different situations involving overpayments.

Administrative

An administrative overpayment is described as "an unemployment insurance overpayment that is created without any fault on the part of the claimant." It can be caused by a number of reasons, including:

- Departmental error

- Amended or delinquent wage reports from employers

- A failure by the employer to submit requested or necessary information in a timely manner

- The employer submitted inaccurate or incomplete information to the claimant or DES

- A successful appeal that "reversed the original determination and disqualified the claimant for all or part of the period in question"

- The claimant gave an incorrect reason for separation, because the employer "did not give a reason for the separation to the claimant and the claimant had no basis to believe that the claimant was not laid off through no fault of the claimant."

"Even though the claimant was not at fault in creation of the Administrative overpayment, the claimant is liable for repayment of the overpayment, plus any accumulated interest on the overpayment," read a portion of the website.

Non-Fraud

A non-fraud overpayment is described as "an unemployment insurance overpayment that is created because the claimant unintentionally gave incorrect or incomplete information to the Department."

Like, administrative overpayment, it can be caused by a number of reasons, including:

- The claimant reporting that he or she worked during a week claimed, but "unintentionally underreported the amount paid."

- The claimant did not realize that he or she was being paid at the time of separation for unused vacation time

- The claimant gave an incorrect reason for separation, because the employer "did not give a reason for the separation to the claimant and the claimant had no reason to believe that the claimant was laid off through any fault of the claimant."

"Even though the claimant did not intentionally cause the overpayment, it was still caused by the claimant, so it is considered the claimant’s fault," read the Department of Economic Security's website on its overpayment policy.

Fraud

A fraud overpayment, according to DES officials, means an overpayment that was created because the claimant "knowingly misrepresented or concealed material facts in order to obtain benefits to which the claimant was not lawfully entitled."

How many Arizonans are affected?

Tens of thousands of Arizonans have learned that they have to pay back their unemployment to DES, due to no fault of their own.

Specifically for 2021, 31,000 Arizonans were told to pay back their funds.

What are people affected by this saying about their situation?

(From top left) Kim Smith, William Ramirez, Brandi Lee and Melissa Vasquez

Melissa Vasquez needed unemployment in 2020. Now, she owes.

"I asked all the questions, I told them what was going on, my background, and they said I qualified only to find out three years later I owe it all back," she says.

Kim Smith also was asked to pay it back.

"I’m like, that’s your guys’ fault. I didn’t do that. Transfer it to my regular claim," Smith says.

William Ramirez says he needed the money when he had a little over $3 in his bank account.

"You’re disappointed when you know you’ve done everything correctly," Brandi Lee says, who also filed for the funds.

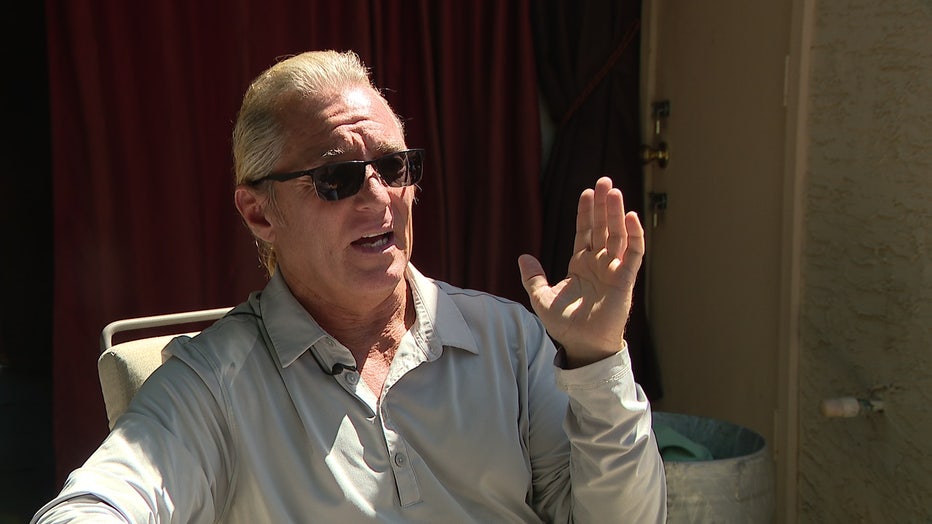

Walter Dolan

Walter Dolan said he received a letter from DES, saying that the state made a mistake, and that he now owes all the employment money he received in 2020: nearly $25,000.

"At this point, you'd have to come take the keys out my hand to get that kind of money," said Dolan

Dolan is also facing interest payments, racking up nearly $60 every month. It is noted in fine prints that "interest does not apply to federal unemployment overpayments."

"It's almost laughable at this point, right?" said Dolan.

Wait. They're charging interest?

In earlier statements, DES officials said they were following federal requirements, and are working to "minimize the impact of overpayments whenever possible."

However, on Aug. 30, officials with DES say they charge 10% interest on regular state unemployment overpayments, citing state law.

"For fraud and non-fraud overpayments for regular UI, interest accrues beginning the month following the overpayment Established Date. For administrative overpayments interest accrues beginning the sixth month following the month of the overpayment Established Date. PUA overpayments do not accrue interest; however, an unpaid balance will remain a debt that is owed back to the Department," read a portion of a statement released by DES on Aug. 30. "As stated previously, DES is committed to collecting overpayments following federal requirements and guidance by the U.S. Department of Labor as it is updated, while continuing to work with individuals and families in unique circumstances to minimize the impact of overpayments whenever possible."

"I think it's a little further than salt in the wound," said Dolan. "They're walking up to the wound, ripping it open a little more, and making sure when the salt goes in. It will really hurt."

What can DES do to recoup the payment?

The agency can withhold state and federal income tax returns, as well as child support, to recoup the overpayments.

In the case of Dolan, his tax returns this year were withheld by the state, and applied to his balance.

What about the people affected? What can they do?

DES officials have previously noted that the department is "sensitive to the impact overpayment situations can have on claimants."

"Claimants with overpayments are able to enter into a repayment plan with the Department to repay the overpayment amount over time," read a portion of its Aug. 30, 2022 statement.

Since then, however, the debts of some of the people affected were waived, after the Feds changed their tune, and said states could wipe away the bills.

Dolan benefited from the debt waiving.

"Went from $25,633.76 down to zero," Dolan said.

There is a catch, however, as people would have to apply for a waiver.

"They could call out they could send letters emails," said Dolan. "They've got everyone's emails, so they could definitely inform everybody."

What should I do to apply?

More information can be found on the DES' website.

DES details information on overpayments

The following statement is from DES, in its entirety:

"From January 1, 2022 to June 30, 2022, DES has established approximately 52,000 overpayments representing $121 million for 27,000 unique claimants that received either regular Unemployment Insurance (UI) or Pandemic Unemployment Assistance (PUA). Of the total, approximately 21,000 overpayments to 10,000 unique claimants representing $11.5 million were reported as non-fraud, and approximately 31,000 overpayments to 17,000 unique claimants representing $110.5 million were reported as fraud. (Quarterly data is reported to the U.S. Department of Labor which identifies overpayments as ‘fraud’ and ‘non-fraud.’ Non-fraud includes overpayments that may be considered ‘administrative.’)

In 2021, DES issued approximately 70,000 non-fraud overpayments to 31,000 unique claimants representing $41 million and 17,000 fraud overpayments to 12,000 unique claimants representing $17 million to claimants who received regular UI benefits.

Please note that claimants may receive multiple Notices of Overpayment. In instances where a PUA claimant experiences overpayment, an overpayment notice is produced for each unemployment program paid. For example, during the pandemic, individuals generally received a weekly payment that included both the base PUA benefit and an additional Federal Pandemic Unemployment Compensation (FPUC) benefit. For weeks in which an overpayment is established, a separate overpayment notice will be created for both the PUA and FPUC programs.

We are committed to collecting overpayments following federal requirements and guidance by the U.S. Department of Labor as it is updated, while continuing to work with individuals and families in unique circumstances to minimize the impact of overpayments whenever possible. Our priority during the COVID-19 pandemic was to establish the PUA program and issue benefits to Arizonans in need of assistance. After launching the new system in 2020, we worked diligently with our vendor to implement the functionality required to establish and collect improperly distributed benefits. DES began issuing Notices of Overpayment for the PUA program in January 2022.

Throughout the duration of the COVID-19 pandemic, however, DES issued overpayment notices for the regular Unemployment Insurance (UI) and Pandemic Emergency Unemployment Compensation (PEUC) programs following the normal process. The overpayments for regular UI and PEUC would also include Federal Pandemic Unemployment Compensation (FPUC), Lost Wages Assistance Program (LWAP), and Mixed Earners Unemployment Compensation (MEUC) overpaid benefits."