Inflation unexpectedly fell to 3% in June

What causes inflation?

There are three factors that could lead to inflation which include demand-pull inflation, cost-push inflation and built-in inflation.

Inflation cooled more than expected in June, a welcome sign for the Federal Reserve even as prices remained uncomfortably high for millions of Americans.

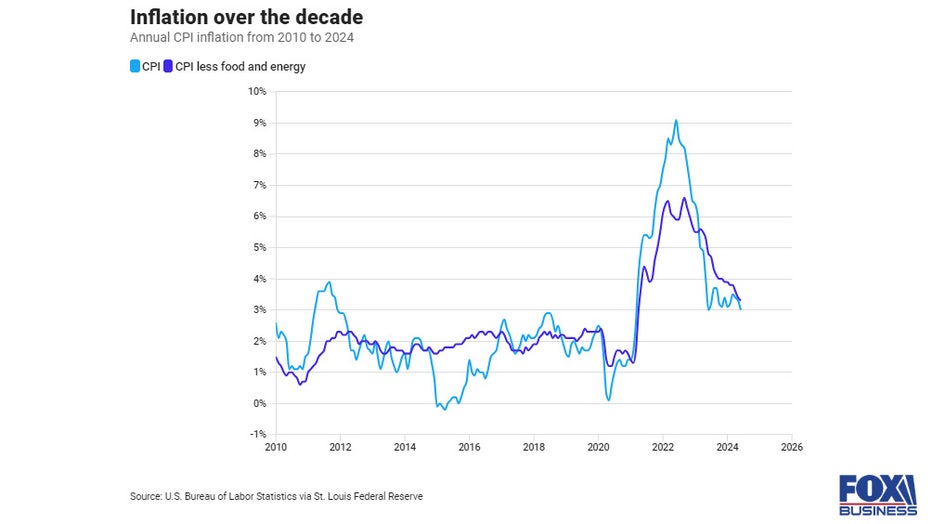

The Labor Department on Thursday said that the consumer price index (CPI), a broad measure of how much everyday goods like gasoline, groceries and rent cost, dropped 0.1% in June from the previous month. It marked the first monthly decline since May 2020. Prices remain up 3% from the same time last year.

Both of those figures are lower than the 0.1% monthly increase and 3.1% headline gain forecast by LSEG economists.

Another data point that measures underlying inflationary pressures within the economy also moderated last month. So-called core prices, which exclude the more volatile measurements of gasoline and food in order to better assess price growth trends, increased 0.1% in June. From the same time last year, the gauge climbed 3.3% — the lowest reading since April 2021.

Altogether, the report indicates that inflation is loosening its stranglehold on the U.S. economy, though prices still remain above the Fed's 2% target.

The softer-than-expected report comes as Federal Reserve policymakers look for evidence that high inflation has been successfully tamed as they contemplate when to start cutting interest rates. Fed Chair Jerome Powell said during congressional testimony this week that more "good" inflation data would bolster the case for rate cuts this year.

"Incoming data for the first quarter of this year did not support such greater confidence. The most recent inflation readings, however, have shown some modest further progress, and more good data would strengthen our confidence that inflation is moving sustainably toward 2 percent," he said.

File: A shopper makes their way through a grocery store on July 12, 2023 in Miami, Florida. The U.S. consumer price index report showed that inflation fell to its lowest annual rate in more than two years during June. (Photo by Joe Raedle/Getty Image

Stock futures surged on Thursday morning and bond yields tumbled as the report fueled hopes that the central bank could cut interest rates by September.

"The latest inflation numbers put us firmly on the path for a September Fed rate cut," said Seema Shah, chief global strategist, Principal Asset Management. "The smallest gain in core CPI since 2021 surely gives the Fed confidence that the hot CPI readings [in the first quarter] were a bump in the road, and builds momentum for multiple rate cuts this year."

LINK: GET UPDATES ON THIS STORY FROM FOX BUSINESS